Minimum Eligibility

- Graduate Degree in any field

- Successful completion of interview

An AICTE Approved one-year course, tailor-made for Indian Students and Finance Professionals looking for a career in Alternative Investments and Start-up Valuation

Graduate Degree from a Recognized University

Government Recognized, Professional Course on Alternative Investments

12 Months (2 Semesters)

Recommended Study: 6 hours/week

Get exposure in the Indian AIF sector

Live-online classes

Rs. 12500/module

The course provides an integrated learning experience with Data Analytics and Machine Learning tools required to apply the investment strategies, perform analysis, and report data in the Alternative Investment Market. Further, it will help you get practical knowledge on different legal structures permissible in Alternative Investment Funds, investment strategies deployed, applicable regulatory norms, due diligence practices, valuation policies, performance attribution and the accounting processes followed in this industry.

Emerging Markets are gaining Private Investors' confidence, with Southeast Asia and India being ranked amongst the top 3 Most Preferred Destinations by Global Investors, as per the Global Limited Partner Survey of Emerging Markets Private Equity Association, 2019 and 2020. Various forms of investment management services are imperative for the development of any economy, as Portfolio Managers understand the investment objectives and constraints of their clients and make suitable investments, as per the investment mandate. Alternative Investments Funds in India, such as Category III AIFs have been investing the funds faster, in order to generate alpha by employing diverse trading strategies.

- Graduate Degree in any field

- Successful completion of interview

(6 Months)

-Subject 1 - Introduction to Alternative Investments

-Subject 2 - Financial Management and Investments

-Subject 3 - Hedge Funds and PMS

(6 Months)

-Subject 4 - Financial Modelling & Data Analytics For Hedge Funds And PMS

-Subject 5 - Private Equity, Venture Capital and Angel Funds

-Subject 6 - Financial Modelling and Data Analytics in Private Equity and Venture Capital

All India Management Association (AIMA) was established in 1957 (as a Society under the Societies Registration Act of India, 1860) as the national apex body of management profession with the active support of Government of India and the Indian Industry. By virtue of its contribution to the development of management profession in India over the last fifty years, AIMA is recognized for its national stature. The Centre for Management Education (CME) is the educational arm of AIMA which offers management education programs nation wide by distance learning through its Study Centers spread across the country. AIMA-CME, the pioneer of management education by distance learning in the country, is recognized by Distance Education Council (DEC) as a Distance Learning Institution to conduct management programs in the country.

CareerTopper was established in 2015 with a mission to bridge the knowledge gap in Alternative Investments and Finance. CareerTopper has provided skill development programs to more than 4000 participants from Regulators, Exchanges, Banks, Start-up Accelerators, B-schools and Training Institutes, on niche topics such as Private Equity, Venture Capital and Hedge Funds.

In addition to enabling corporate professionals, CareerTopper has been working closely with finance aspirants and students, by providing them virtual training programs in Finance, Risk Management, Alternative Investments and Wealth Management.

Archit is passionate about the Alternative Investments Market and aims at enabling finance professionals to hone the niche skills within this market. He is Chapter Executive of the CAIA Association India Chapter and an active member of the CFA Society, India. He has worked with Ernst & Young and BSE Ltd., in areas such as, Regulations, Compliance, IPO Process, Information Management Systems, Investment Analysis, Audit and Finance. His start-up works for Indian Regulators, Banks, Mutual Funds, Foreign Universities, Start-up Accelerators and a number of Training Institutes and B-schools.

He likes to write books and articles on the Alternative Investments industry and is a regular speaker at national and international forums.

Namarta is a Finance trainer with over 14 years of Industry experience. She has been associated with Moody’s Analytics Knowledge Services (MAKS), since 2007. Since 2016 she has been handling independent training projects. Also, she is a member of The Indian Society for Training & Development (ISTD). Her areas of expertise include, Financial Modelling, Company Valuation, Corporate Finance, Finance and Accounting Management Analysis, Finance for Non-Finance, Investment Banking Research Services, Fundamental Analysis, Equity Research, amongst others. As a freelancer, she has been conducting training for AIMA, NSE, BSE, Ernst & Young, IMS, WNS, Exevo, Genpact, Reliance Capital, Edelweiss, IIFL etc. Namarta holds a Bachelors Degree in Commerce from Delhi University and a Masters in Business Administration from Guru Gobind Singh Indraprastha University, Delhi. She has also done her Diploma in Security Analysis and Portfolio Management from the Institute of Financial Management, Delhi.

The participants will be required to appear for a Certification Assessment.

The assessment will comprise of online assignments (30% weightage) and final end term examination (70% weightage).

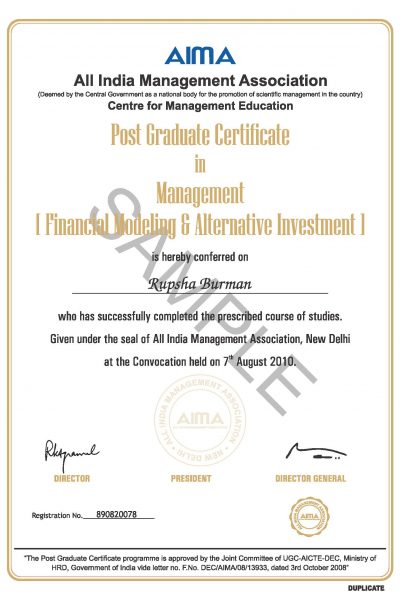

Upon successful completion of the assessment, all the participants shall be eligible to earn the Post Graduate Certificate in Management in Financial Modelling & Alternate Investments.

After successful completion of this program, candidates would be suitable to explore professional opportunities in the following:

Professionals who can seek this program are:

14, Institutional Area, Lodhi Road,

New Delhi - 110003

Phone: +91-98919 63303 / 011- 24645100

Email: rbhatia@aima.in

Website: www.aima.in

525, Arun Chambers, 5th Floor, Tardeo,

Mumbai 400 034, Maharashtra, India

Phone: +91-93213 06866 / 022-35103515

Email: info@careertopper.com

Website: www.careertopper.com

Upon the successful completion of this program, you will get a Post-Graduation Certificate duly signed by the directors of AIMA-CME and CareerTopper. This certificate is approved by the All India Council for Technical Education (AICTE) and is equivalent to a Professional Qualification for the Alternative Investment industry.

Ideally, you will have to spend 10 to 15 hours per week during the course of the program to learn and pass this course successfully. Overall, this program is for duration of 12 months (2 Semesters each of 6 months).

525, Arun Chambers, 5th Floor, Tardeo, Mumbai - 400034. Maharashtra, India.

info@careertopper.com

+91 932 130 6866

Copyright © 2022 Career Topper. All Right Reserved. Designed & Developed by Witty Web Solution.