Biden! Impact on Foreign Investments in India

June 23, 2021Posted by : Career Topper Content TeamNo Comments

India and the United States

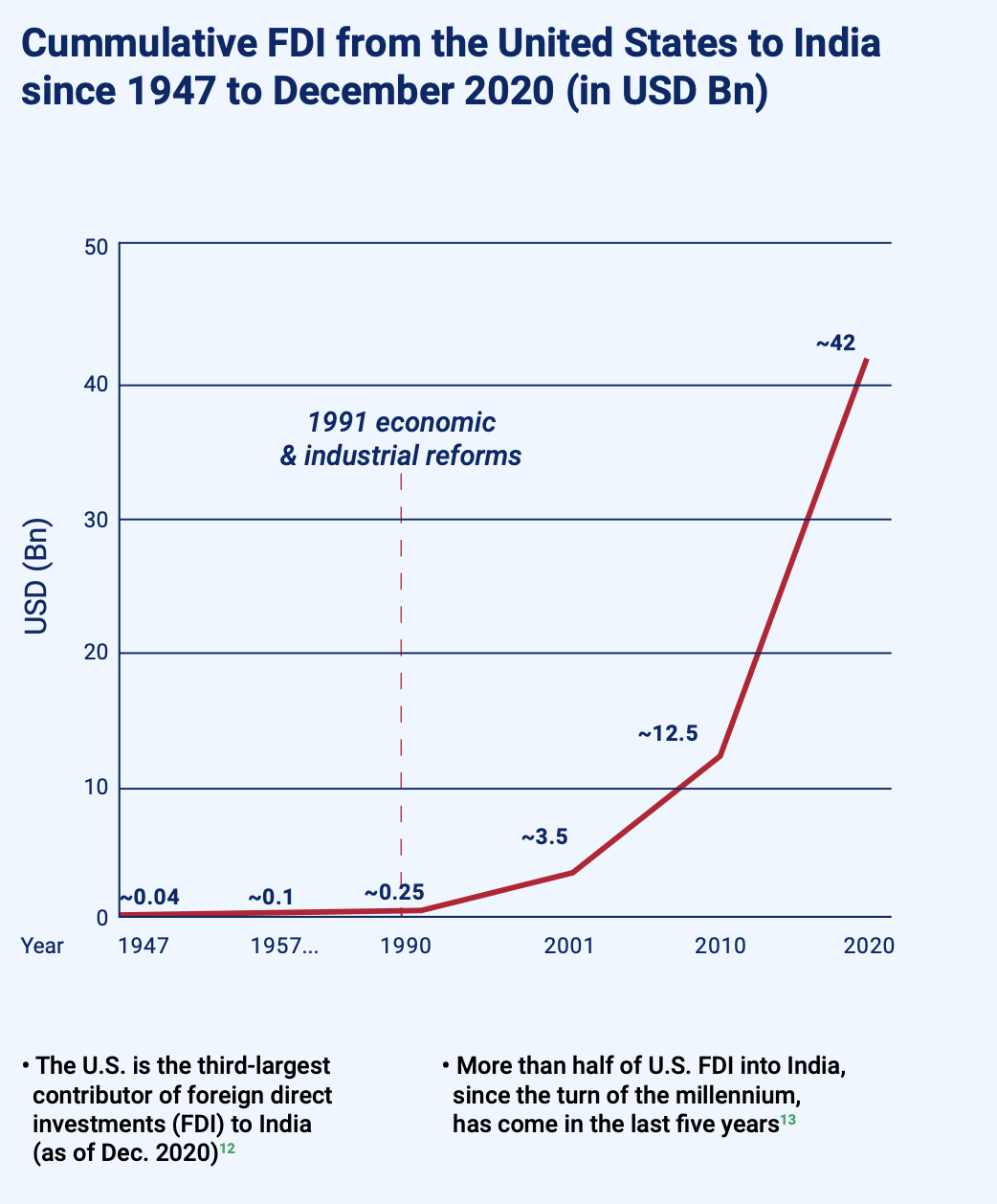

India-U.S. bilateral relations have developed into a “global strategic partnership”, based on shared democratic values and increasing convergence of interests on bilateral, regional and global issues. India and the United States have been on good terms for a very long period of time, this is visible through the less restrictive policies for the majority period of the time. Lenient policies and abundant liquidity have proven to be a great catalyst for FDI inflows in India from the US. According to the U.S. Bureau of Economic Analysis, US direct investments in India stood at $ 28.33 billion in 2015. As per Indian official statistics, the cumulative FDI inflows from the US from April 2000 to December 2015 amounted to about $ 17.94 billion constituting nearly 6% of the total FDI into India. U.S. Foreign Direct Investments in India has increased to $ 45.9 billion in 2019 which brings it in the top 3 countries to invest in India with a share of 8% of the total inflows.

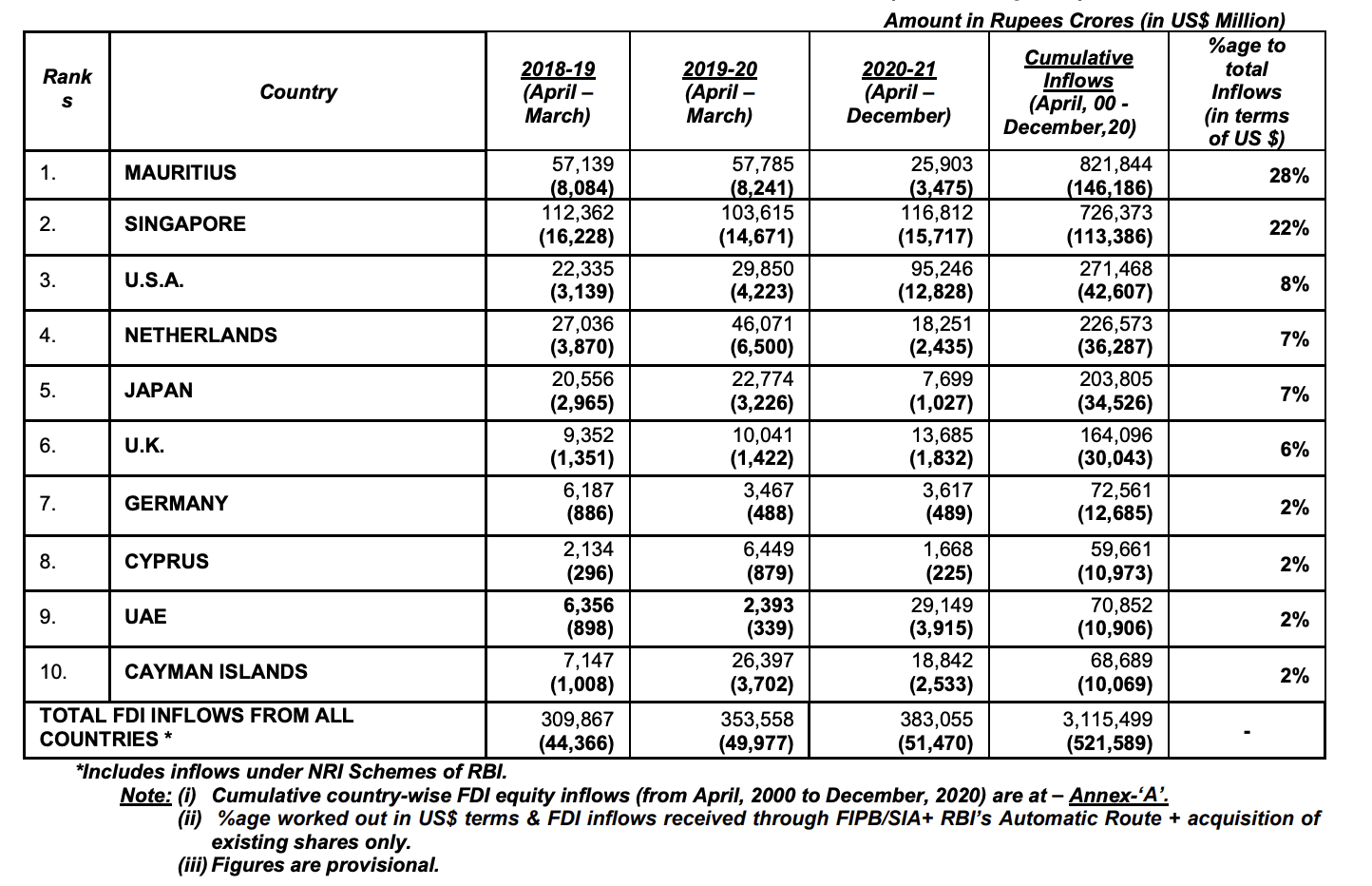

Figure 1: Foreign Capital Inflows in India, over 3 years

Figure 2: Cumulative FDI Inflows in India, from USA

Elections and Stock Markets

At age 29, President Biden became one of the youngest people ever elected to the United States Senate. As a Senator from Delaware for 36 years, President Biden established himself as a leader in facing some of our nation’s most important domestic and international challenges. As Chairman or Ranking Member of the Senate Foreign Relations Committee for 12 years, Biden played a pivotal role in shaping U.S. foreign policy. As Vice President, Biden continued his leadership on important issues facing the nation and represented our country abroad. On April 25, 2019, Biden announced his candidacy for President of the United States. In January 2021 he assumed office as the 46th President of the United States of America.

From 1926 to 2019, the US had a Republican president for 46 years, and a Democratic president for 48 years. The difference in returns between the parties is significant. The average annual return for the S&P 500 index when the US had a Republican President was 9.12%. whereas for a Democratic President, the S&P 500 averaged 14.94% per year.

The charts below show how the major indices have performed since Mr. Joe Biden assumed office on 20 January 2021.

Figure 3: Performance of NASDAQ

Figure 4: Performance of Dow Jones Industrial Average (DJIA)

Figure 5: Performance of S&P500

India's Response after Biden's Election

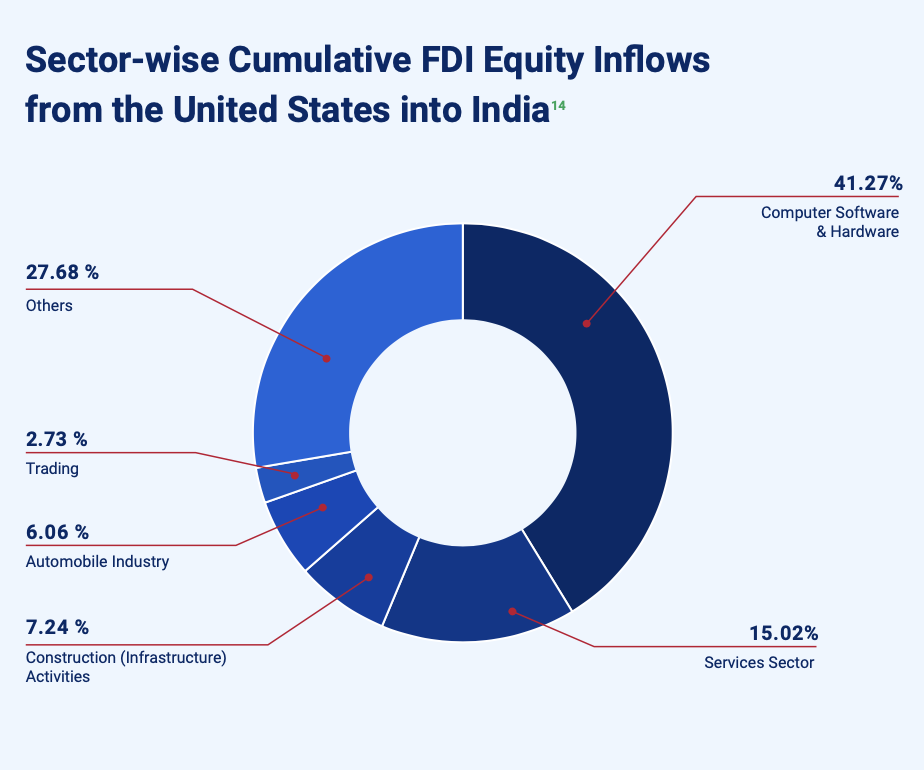

Figure 6: Sector-wise Cumulative Inflows

Global supply chains have shifted, and continue to shift, considerably in the wake of the pandemic. They have provided an added incentive to India’s rapidly transforming manufacturing driven economy. The government of Prime Minister Modi has eased many FDI regulations to make India a favored destination of investors and drive the country’s manufacturing capabilities. Key sectors such as aviation, automobiles, capital goods, e-commerce, IT-BPM, pharmaceuticals, financial services and renewable energy, all of which are pillars of the Indo-U.S. bilateral relationship, have been opened to 100 percent FDI through the automatic route. Defense manufacturing, too, a cornerstone of the relationship, has been opened to 74 percent FDI through the automatic route, an increase from the previous 49 percent. In addition to its policy recalibration, India is home to a vibrant working age population which is expected to reach 800 million by 2050. It also has over 735 million internet users as of March 2021 and is the second-largest smartphone market in the world. With the availability of cheap data, the internet has become, in many ways, the driver of India’s growth. As the events of 2020 have shown, the reliance on the internet and internet driven activity has only furthered emerging sectors such as ed-tech, digital health and artificial intelligence in defense that are creating optimal opportunities for American investors.

Biden's Impact on Indian Trade and Markets

The victory of Joe Biden is a mixed bag for India, while there could be good news for the IT/ ITesS sector with the H1 visa. The Biden administration might bring in policies for the removal of incentives for Pharmaceutical companies setting up factories abroad which in turn will force them to set up in the US itself. As of 100 days of the Biden administration, there is no major policy change that would affect the current trade practices between India and the US. During the COVID-19 pandemic, China, the world’s largest manufacturing, has faced a lot of backlash from around the world which has resulted in less FDI in China and has brought India to the forefront. However, Biden’s plan to ‘Make in America’ by penalizing American companies that build overseas and rewarding businesses that employ US residents may prove to be negative for India. Also, policies such as 'Make in America' may restrict India's potential to host much more FDI from the US.

Share: